8/26/2020

5 ways to accelerate corporate venture capital

We want to share with you some interesting material about corporate venture investments. It is no secret that during a pandemic and a global economic downturn, many venture capital companies are forced to slow down their investment rates. However even in such a challenging period, there are effective ways to fight the recession by focusing on the effectiveness of commercial transactions. We want to share with you Beth Kearns' theory of "shifting gears" – 5 types of multilateral transactions that can potentially add value to an investment portfolio and expand the influence of the corporation as a whole.

Beth Kearns has a distinguished career: after graduating from Stanford, he spent over 10 years in senior positions at 20th Century Fox, including as Executive Vice President. Currently, Kearns is a venture partner at Touchdown Ventures: helping corporations launch and manage their own investment programs. We can all agree that a person with such experience can be trusted when it comes to investing and having successful business models.

In his article Shifting Gears on Medium, Kearns highlighted 5 multilateral commercial transactions that can help venture capital companies attract additional income, cut costs, develop a corporate culture, and share innovative knowledge. So, let's start shifting gears:

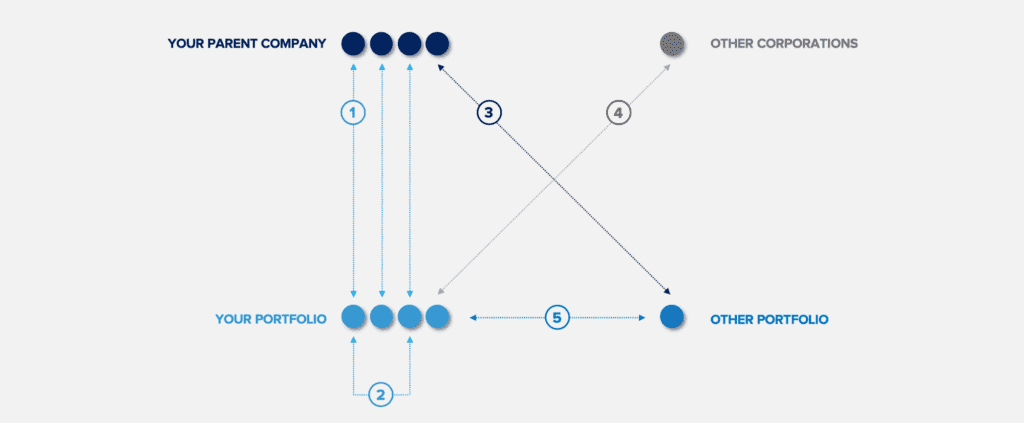

- Deals between your parent corporation and your portfolio companies

VCs often do not have commercial agreements with their portfolio companies, although this type of transaction can bring tangible benefits: improve the portfolio company's product, as well as help with its implementation and distribution in the market. According to Beth, it is important to consider entering into commercial agreements with each of the portfolio companies.

- Deals between your portfolio companies

In times of economic uncertainty, it is especially important that portfolio companies complement each other, develop partnerships, and expand their market presence.

- Deals between your parent company and other portfolio companies

This type of transaction will provide an excellent opportunity to build partnerships with companies in which you plan to invest in the future. In addition, deals with third party portfolio companies are good to maintain a reputation in the venture capital community.

- Deals between your portfolio companies and other corporations

With such deals, you can help your startups raise additional funding, as well as add some of the top corporations to the list of potential clients. Such a business strategy will make you a more attractive investor for future projects.

- Deals between your portfolio companies and other portfolio companies

At first glance, these partnerships may seem secondary, but in the long term, these are the deals that will help you expand your market presence and build mutually beneficial relationships with other large corporations.

To summarize, it can be said that focusing on multilateral commercial transactions can improve the success of venture capital investments even during the global economic downturn.

The original article can be read at https://medium.com/touchdownvc/shifting-gears-7ab0bc644ba2